FAQs

General (Applications, Devices, Requirements)

Rize is a new digital bank and is separate from any account you may already own and have access to through alrajhi@24seven. Rize will bring you a new digital banking experience and exciting digital financial products and services entirely via your smartphone with no visit to the branch.

Download the Rize app from Apple Store, Google Play or Huawei AppGallery. You will need a valid MyKad (sorry, MyTentera cardholders are not currently eligible, but we're working on it!). Simply follow the on-screen instructions to open an account.

A Rize account can only be opened through the Rize app, which is available at Apple Store, Google Play Store and Huawei AppGallery. Rize customer support and branch employees are always available for any inquiry.

Our automated system will review your application and notify you once it is approved. Once approved, you can then proceed to activate your account by transferring a minimum of RM20 via DuitNow Transfer from your own account with another registered bank into your new Rize account. Interbank GIRO transactions will not be accepted.

No, you do not need to walk into any branch. All verification and approvals are done via the smartphone application. Our customer support is on hand should you need help.

Yes, you may reapply. Kindly ensure you meet the eligibility criteria in the General Terms of Use.

The minimal software requirements to install the Rize app are as follows:

- iOS 15 and above.

- Android 11 and above.

- Huawei Harmony OS version 3 (EMUI 13) and above.

Currently, Rize is only open to Malaysian citizens with a blue MyKad. We are continuously working towards expanding the availability to everyone across Malaysia. You will hear from us as we grow.

You are required to have at least 1 (ONE) bank account in your name at another registered bank in Malaysia (we accept alrajhi bank Malaysia account) as part of the account opening verification process.

A minimum initial deposit of RM20 from that account will need to be transferred into Rize for account activation.

Rize will serve your banking needs with a wide range of financial services such as:

- Deposits, withdrawals, and transfers (via DuitNow or QR Pay)

- Account management and personal finance management (spend analysis)

- Savings pots (to customize and support your savings needs)

- Debit card application, purchases, and maintenance

- ATM services and eStatements

Many more exciting features and products are coming your way.

Yes, all you need is the smartphone device on which you have installed the Rize app, and an internet connection via Wi-Fi or cellular data roaming to access the Rize app.

Download the Rize app from Apple Store, Google Play, or Huawei AppGallery. You will need a valid MyKad (we’re sorry, MyTentera cardholders are not eligible for now). Simply follow the on-screen instructions to open an account.

Currently, Rize is only open to Malaysian citizens with a blue MyKad. Malaysians with a MyTentera card are not eligible for now. We are continuously working towards expanding the availability to everyone across Malaysia. You will hear from us as we grow.

Yes, Rize is open to all Malaysians with a blue MyKad, even if you are holding an alrajhi bank Malaysia account.

- Malaysian citizen with a valid MyKad. We’re sorry, MyTentera cardholders are not eligible for now.

- 18 years of age and above.

- Applicant must be a tax resident in Malaysia (Malaysian taxpayer and not of another country).

- Hold an active bank account with another bank in Malaysia.

Accounts & Cards

- Malaysian citizen with a valid MyKad

- 18 years of age and above

- Applicant must be a tax resident in Malaysia (Malaysia taxpayer and not of another country)

- Hold an active bank account with another bank in Malaysia.

- You should receive your OTP at the point of onboarding while registering your device (we do not use OTP for account opening or transaction verification)

- Please ensure your smartphone number is entered correctly during the registration process

- Please contact your telco provider and report the delay in receiving the OTP.

You can only open one Rize account linked to your MyKad identification.

Yes, your deposit with Rize Savings Account-𝘪 is protected by up to RM250,000.00 by Perbadanan Insurans Deposit Malaysia (PIDM).

You may close your Rize account by contacting Rize Customer Support. Contact details are on the Rize app.

A spouse or family member may only assist in specific circumstances. For account closure due to death/being in a coma/dementia (or the like), it is a requirement for the customer’s next of kin/executor/administrator to submit an official account closure application to Rize Customer Support via the email address rize-cs@alrajhibank.com.my. Once we receive the official application, we will email detailed instructions and a list of supporting documents that the next of kin/executor/administrator is required to provide to the Bank. All account activities will be suspended when the official request is received from the next of kin/executor/administrator.

Currently, only individual account is offered through the Rize app.

Fund Transfers

- DuitNow is a convenient way to transfer money instantly to your recipients using DuitNow ID, including your smartphone number, MyKad/passport number, army/police number, business registration or account number.

- No, it is FREE for consumers to send and receive money up to RM5,000. For transactions above RM5,000, a RM0.50 sen fee is applicable.

- The maximum combined limit set for third party transfer, DuitNow (Instant Transfer), and DuitNow QR is RM50,000.00 per day.

- You may change the limit set under ‘Account Settings & Limits’ section in the Rize App.

No. Any Interbank GIRO transaction made into your Rize account will be rejected and refunded into the source account.

- DuitNow Transfer (1st and 3rd parties)

- DuitNow QR (1st and 3rd parties

Savings Pot

Savings Pot is a goal savings feature in the Rize app. You may create up to 3 savings pots to achieve your savings goals.

You can transfer money from your savings account to your savings pot and you may withdraw any amount from your savings pot at any time.

- Yes, profit rate is applicable for savings/deposits in a savings pot.

- Please refer to Rize Savings Account Product Disclosure Sheet for the latest applicable profit rate (%).

Your money will remain in the savings pot for seven (7) years. If your account is still inactive after seven (7) years, your money will be treated/transferred as unclaimed monies under the Unclaimed Money Act (UMA) 1965.

Yes, your savings pot transaction history will appear in the combined statement under Personal Statement. You will receive automated eStatements monthly from your Rize app.

- You may add up to 3 savings pots at any time within the Rize app to create multiple savings goals.

- You can share your savings goal with friends and family to contribute to your saving goals.

Security

- Rize security is setup using the latest cloud-based technology with biometric authentication.

- Your access is protected by a strict authentication process with only one session allowed per user at a time.

- Only single-device binding is allowed for each user.

Rize uses biometric authentication (face recognition or fingerprint as selected by you) every time you login to the app. You may also use device pin verification for access.

Please follow the steps below to reset your password:

- On the login screen, tap on the “Forgot Password” option.

- You will be asked to confirm your “Secure Word”

- Then, enter your NRIC.

- After that, a temporary password will be sent to your registered email address.

- Now, log in to the app again and confirm your “Secure Word”

- You will then be prompted to enter the temporary password emailed to you.

- Finally, create a new password, and you will see a confirmation message on the screen once it’s completed.

If you change your smartphone, simply download the Rize app on your new phone and login using your existing username and password. You will be asked to authenticate and authorize to bind the new device. The previous tagging to your old device will be removed automatically. You will not be able to access your Rize account from your old device.

- The Rize app cannot be accessed by other individuals without your user ID and passcode and/or biometric authentication. For security purposes, do not store any account details or password in your device.

- Contact our Rize Customer Support at 1800 819 149 or email us at rize-cs@alrajhibank.com.my to temporarily block access to the Rize account.

- Once you have your new smartphone, simply call us to unblock the access and download the Rize app to your new phone. You may login using your existing username and password.

- You are advised to change your password.

- If you retain your existing smartphone number with the new telco provider, you do not need to do anything.

- If you change your smartphone number with the new telco provider, please log in to the Rize app on the same device and update your smartphone number in the Profile page.

- Take extra precaution with login details. Do not share login information, including your OTP, with anyone; set a strong password containing a combination of uppercase and lowercase letters, numbers, and special characters.

- Be mindful of the apps you are downloading on to your phone. Only download and install apps from official app stores, i.e., Apple AppStore, Google Play Store or Huawei AppGallery, to avoid malware/viruses.

- Keep your smartphone up to date. Having the latest security software and operating system is the best defenses against viruses, malware, and other online threats. Turn on automatic updates so you receive the newest fixes as they become available.

- Beware of phishing and smishing scams. Do not click on links or open any attachments or pop-up screens from sources that you are not familiar with in email, WhatsApp messages, or SMS.

- Do not share your personal information online. Be wary of requests to connect from people you do not know.

- Secure your internet connection. Always protect your home wireless network with a password. Avoid using public Wi-Fi for your banking needs

- When in doubt, call Rize Customer Support via the Rize app ‘Contact Us’ feature.

- If the caller is asking for your password or OTP, do not continue with the call. We will never ask for these details.

- When in doubt, always end the call and call Rize Customer Support via the app ‘Contact Us’ feature.

Personal Financing

Not at present. We are considering Takaful Coverage as an optional add-on product soon.

You may incur charges if you fail to fulfill your obligations under the Personal Financing-i. Please refer to our product disclosure sheet in the Rize smartphone app or contact Rize Customer Support via the app ‘Contact Us’ feature.

You may pay your monthly instalments through the Rize app. The monthly payment will be auto debited from your savings account.

Should your savings account have insufficient monies, you will receive a notification in the app asking for a top-up of funds or for a partial payment to be made. We would encourage you to contact Rize customer support if you are facing challenges or difficulties.

If you have difficulties in making monthly payments, you should contact us earliest possible to discuss payment alternatives.

Rize Customer Support

Level 6, Menara Hap Seng 3,

No 1, Jalan P. Ramlee,

50250 Kuala Lumpur

Telephone: Customer Support : 1800 81 9149 (Within Malaysia) / +6016-299 6610 (From Abroad) 24hrs Fraud Support : +6016–299 5333 (Within Malaysia & From Aboard)

Email: Rize-cs@alrajhibank.com.my

Alternatively, you may seek the services of Agensi Kaunseling dan Pengurusan Kedit (AKPK), an agency established by Bank Negara Malaysia to provide free services on money management, credit counselling, financial education and debt restructuring for individuals.

You are also encouraged to attend the “Program Pengurusan Wang Ringgit Anda” or “POWER” oragnized by AKPK which promotes prudent money management and financial discipline to individual borrowers. You can visit website at www.akpk.org.my or contact AKPK at:

Level 5 and 6, Menara Bumiputra Commerce,

Jalan Raja Laut,

50350 Kuala Lumpur

Tel: 03-2616 7766

e-mail: enquiry@akpk.org.my

Contact

You may reach our 24-hour hotline at:

Customer Support Line (Local toll-free)

1800 81 9149

Customer Support Line (Local & overseas)

+6016 299 6610

Fraud Hotline (Local & overseas)

+6016 299 5333

Email: rize-fraud@alrajhibank.com.my

Customer Support Email

rize-cs@alrajhibank.com.my

Our Support team operates 24 hours, 7 days a week.

Kill Switch

This self-service security feature allows our customers to instantly lock their Rize app or account access, if they:

- Suspect or have fallen victim to any online fraud or scams, and/or

- Suspect their accounts have been compromised.

Once this feature is enabled, neither the customer nor anyone else can access or log in to their Rize app or account.

The Kill Switch should be used if you suspect you have fallen victim to online fraud or scams or think your account has been compromised.

The Kill Switch feature will:

- Log out all active sessions of the Rize app

- Block or prevent any unauthorized transactions

- Block any further login attempts

To activate the Kill Switch from your Rize mobile app :-

Step 1: Launch the Rize mobile application

Step 2: Go to Settings & Service

Step 3: Click on Account & Card settings

Step 4: Toggle and activate Kill Switch

Step 5: Click on the 'confirm' button

You and all other active login sessions will be logged out automatically and no one including yourself will be able to access your Rize mobile app.

To reactivate your access, contact our Rize Customer Support at 1800 819 149 (Local toll-free) and +6016 299 6610 (Local & overseas) for assistance. All customers will be required to complete a strict identity verification process to proceed with the User ID reactivation.

Once the Kill Switch has been activated, a ‘Rize access has been deactivated’ notice will appear when you attempt to open the app.

All logins to the Rize app and accounts will be disabled once the Kill Switch has been activated.

Contact our 24/7 Fraud Hotline at +6016 299 5333 (Local & overseas) immediately to report your account’s suspected scam/fraud.

Call our 24/7 Rize Customer Support line at 1800 819 149 (Local toll-free) and +6016 299 6610 (Local & Overseas) to reactivate your Rize access.

Customers must complete a strict identity verification process to reactivate the User ID.

Once our customer support team completes the identity verification process successfully, customers may access their Rize app immediately and perform any transaction as usual.

Yes, all scheduled or existing standing instructions or financing repayments will still be executed on the effective date even when the Kill Switch is activated.

Yes, you can still use your Rize debit card for withdrawals, physical purchases, or online transactions.

No, to temporary block your Rize debit card from any transactions you may log in to the app and activate ‘Temporary freeze card’.

No. You cannot make any payments on the Rize app once the Kill Switch is activated.

Call our 24/7 Rize Customer Support line at 1800 819 149 (Local toll-free) and +6016 299 6610 (Local & overseas) to reactivate your Rize access.

Yes, you can still receive incoming transfers made to your account. Your contacts can continue to transfer funds to you using your DuitNow details.

Cooling Off Period

A cooling-off period is an added security measure which prevents anyone from logging into your Rize account for a temporary time. The 12-hour cooling-off period is aimed at preventing unauthorized access and transactions.

After installing the Rize app or switching to a new device, customers must wait for a 12-hour cooling-off period before performing or approving any banking transactions. The 12-hour period begins upon completion of the first-time login.

This security measure is to prevent any unauthorized access to your Rize account and replaces the existing call verification process.

During the 12-hour cooling off period, the following will either be inaccessible or disabled:

- ATM cash withdrawals with Rize debit card

- ATM fund transfers with Rize debit card

- Fund transfers (DuitNow to accounts/proxy/QR)

- Transfers within own account (e.g. Savings Pots, Financing Accounts)

- All recurring charges and standing instructions using Rize account or Rize debit card

- All financing payments

- All Visa and MyDebit transactions using ATMs or Rize debit card - physical or digital transactions.

The 12-hour cooling off period will start upon:

- The successful transaction of RM20 fund transfer to activate your new Rize account.

- After your new/switched device has successfully bound with the app and its passcode settings are complete.

You will also receive a Push notification on your Rize app once the cooling off period has ended.

Contact our 24/7 Customer Support Line at 1800 819 149 (Local toll-free) or +6016 299 6610 (Local & overseas) for assistance.

Important Documents

General Terms and Conditions

Specific Terms and Conditions

National Addressing Database (NAD) Terms and Conditions

DuitNow Transfer Terms and Conditions

DuitNow QR Terms and Conditions

DuitNow Online Banking/Wallets Terms and Conditions

Internet and Mobile Banking Terms and Conditions

Personal Financing-𝘪 Terms and Conditions

Important Notices

25 October 2024

Dear customer,

Please be informed that the Financial Insights feature will be unavailable from the next app update.

We’re sorry for the inconvenience, but we’re working on several exciting updates to this and other features for you in the coming days.

We’ll keep you posted.

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd

Registration Number 200501036909 (719057-X)

23 October 2024

Dear customer,

Please be informed that Rize only accepts DuitNow Transfer or DuitNow QR for incoming transfers.

Interbank GIRO transfers will not be accepted.

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd

Registration Number 200501036909 (719057-X)

22 October 2024

Hi Rizers,

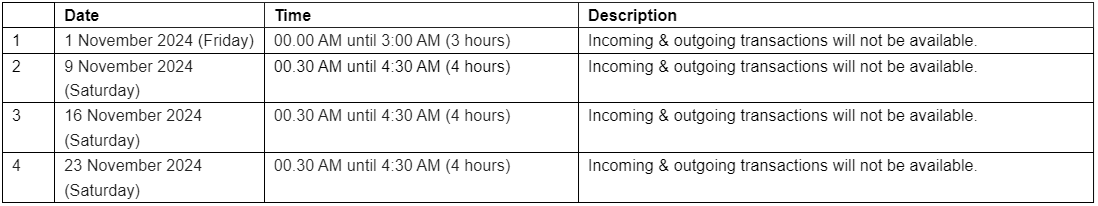

Please be informed that the Rize app is scheduled to undergo necessary system maintenance at the following times:

We apologize for any inconvenience this may cause. Don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & overseas).

24 September 2024

Hi Rizers,

Please be informed that the Rize app is scheduled to undergo necessary system maintenance at the following times:

- 1 October 2024 (Tuesday) from 00.00 AM until 3:00 AM (3 hours) - Incoming & outgoing transactions will not be available.

- 3 October 2024 (Thursday) from 01.00AM until 3:00 AM (2 hours) - Incoming & outgoing transactions will not be available.

- 15 October 2024 (Tuesday) from 01.30 AM until 8:00 AM (6 hours and 30 minutes) - Incoming & outgoing transactions will not be available.

- 19 October 2024 (Saturday) from 01.00 AM until 6:00 AM (5 hours) - Incoming & outgoing transactions will not be available.

- 26 October 2024 (Saturday) from 00.30 AM until 4:30 AM (4 hours) - Incoming & outgoing transactions will not be available.

We apologize for any inconvenience this may cause. Don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & overseas).

20 September 2024

Dear Rize Personal Financing-i Customers,

Please be informed that the Rize Personal Financing-i Application Document in the app, under “Important Documents”, has been revised. The revisions only apply to customers who currently have a Rize Personal Financing-i account.

The changes made to the document are as follows:

- The “3 days grace period” has been removed as it is no longer applicable.

- This revision will come into effect on 12 October 2024. Please clickherefor the latest Personal Financing-i Product Disclosure Sheet.

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd

Registration Number 200501036909 (719057-X)

Dear Rizers,

Effective from 11 th July 2024, a 12-hour cooling off period will be in effect when customers activate DuitNow QR for the first time, and when customers request an increase in transaction limits for any of the following channels:

- DuitNow to Proxy

- Within Bank Account

- DuitNow to Account

- DuitNow QR Limit

The cooling-off period is a 12-hour waiting period from the submission of a new application or request. This period will apply to all other channels as listed above.

Here are some FAQs to address any concerns:

- Why do we need this 12-hour cooling-off period?

The additional cooling-off period aims to prevent unauthorized transactions following the increase in transaction limits and the activation of DuitNow QR.

- Will the 12-hour cooling-off period apply to all transaction channels after increasing the limit for just one transaction type?

No. For example, if you choose to increase the transaction limit for the activation of DuitNow QR, the 12-hour cooling-off period would only apply to transactions using that channel. You will still be able to complete other transactions using other available channels.

- Will the 12-hour cooling-off period be applied if I choose to lower the transaction limit?

No, the 12-hour cooling-off period only applies to requests to increase transaction limits.

- While the 12-hour cooling-off period is in effect for a certain transaction channel, what would happen if I either increase the transaction limit again or reduce its limit?

- If you increase the transaction limit again for that transaction channel, the cooling-off period will restart.

- Reducing the limit after increasing it beforehand will not remove the current 12-hour cooling-off period. Hence, the cooling-off period will remain for that transaction channel until the 12 hours have elapsed.

- What happens after I activate DuitNow QR?

The 12-hour cooling-off period will come into effect, and you will only be able to perform DuitNow QR transactions after the 12 hours have elapsed.

If you have any queries, please call our 24/7 Customer Support team on 1 800 819 149 (Local toll- free) or +6016 299 6610 (Local & overseas) or email us at rize-cs@alrajhibank.com.my.

Thank you for your cooperation in ensuring a secure online banking experience.

From,

The Rize team

Published date: 1 March 2024

Dear Rizers,

We’re continually updating our security measures for Rize. To keep your mobile banking experience safe and secure, the Rize app will only support mobile phones operating on iOS 15 and above, Android 11 and above, or Huawei Harmony OS version 3 (EMUI 13) and above effective 1 June 2024.

To avoid any service interruption, please ensure your device is updated to the latest operating system. No action is required if your device is already running on the latest OS.

Here are some FAQs to address any concerns:

1. Why is there a minimum phone OS requirement?

Outdated operating systems may no longer receive security updates, leaving your device vulnerable to cyber-attacks and malware. With evolving cyber security threats, regular updates are more important than ever.

2. Which OS do I need?

From 1 June 2024, iOS users should be on iOS 15 and above, Android users on Android 11 and above, and Huawei users on Huawei Harmony OS version 3 (EMUI 13) and above.

3. How do I check or update my phone OS?

Navigate to ‘Settings’ on your mobile device and select ‘About Device’. You should find an option to update your OS version.

4. What if I’m unable to update my phone OS?

You may need to check if your mobile device is compatible with the required OS version. If not, consider upgrading to a device that supports the necessary OS version.

For further assistance or inquiries, please reach out to our 24/7 Customer Support team at 1800 819 149 (Local toll-free) or +6016 299 6610 (Local & overseas), or email us at rize-cs@alrajhibank.com.my.

Thank you for your cooperation in ensuring a secure mobile banking experience.

Thank you,

Rize

Published date: 30 April 2024 (Updated)

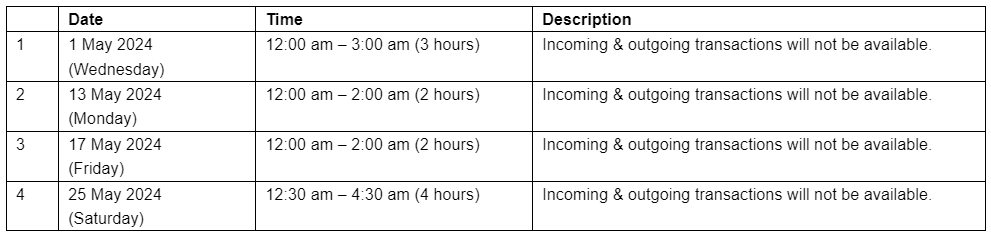

Hi Rizers,

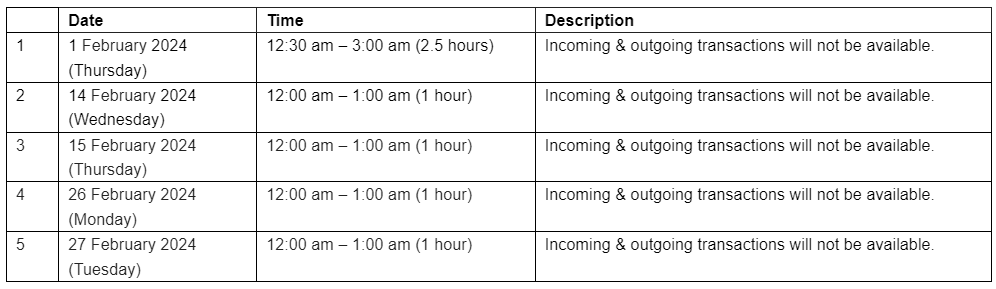

Please be informed that the Rize app is scheduled to undergo necessary system maintenance at the following times:-

We apologize for any inconvenience this may cause. Don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & overseas).

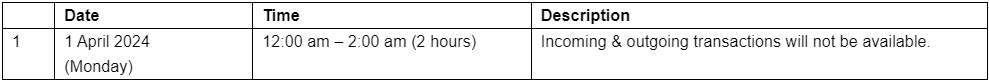

Published date: 23 April 2024

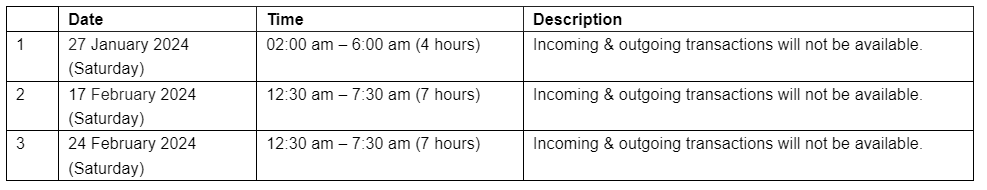

Hi Rizers,

Please be informed that the Rize app is scheduled to undergo necessary system maintenance at the following times:

We apologize for any inconvenience this may cause. Don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & overseas).

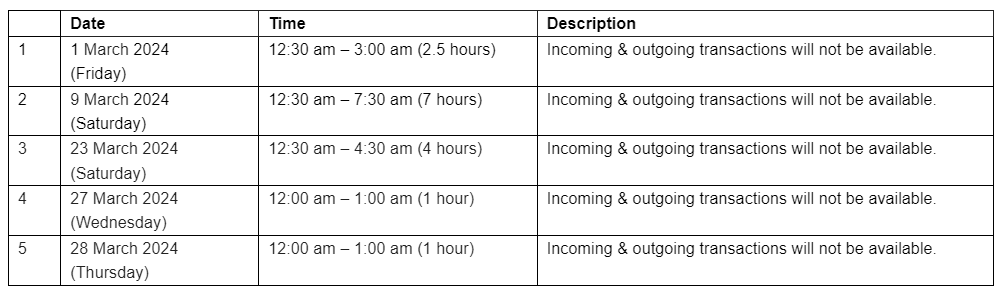

Published date: 25 March 2024

Hi Rizers,

Please be informed that the Rize app is scheduled to undergo necessary system maintenance at the following times:

We apologize for any inconvenience this may cause. Don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & overseas).

Published date: 26 February 2024

Hi Rizers,

Please be informed that the Rize app is scheduled to undergo necessary system maintenance at the following times:

We apologize for any inconvenience this may cause. Don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & overseas).

Published date: 31 January 2024

Hi Rizers,

Please be informed that the Rize app is scheduled to undergo necessary system maintenance at the following times:

We apologize for any inconvenience this may cause. Don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & overseas).

Published date: 22 January 2024

Hi Rizers,

Please be informed that the Rize app is scheduled to undergo necessary system maintenance at the following times:

We apologize for any inconvenience this may cause. Don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & overseas).

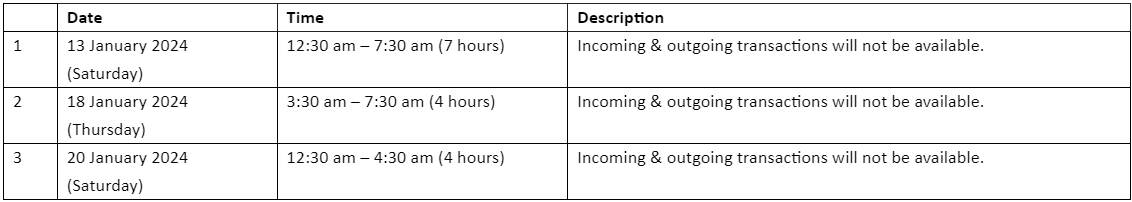

Published date: 9 January 2024

Hi Rizers,

Please be informed that the Rize app is scheduled to undergo necessary system maintenance at the following times:

We apologize for any inconvenience this may cause. Don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & overseas).

Published date: 28 December 2023

Hi Rizers,

Please be informed that the Rize app will be temporarily unavailable due to necessary system maintenance on Monday, 1 January 2024 from 12.00 am to 6.00 am. We apologize for any inconvenience this may cause, but don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & Overseas).

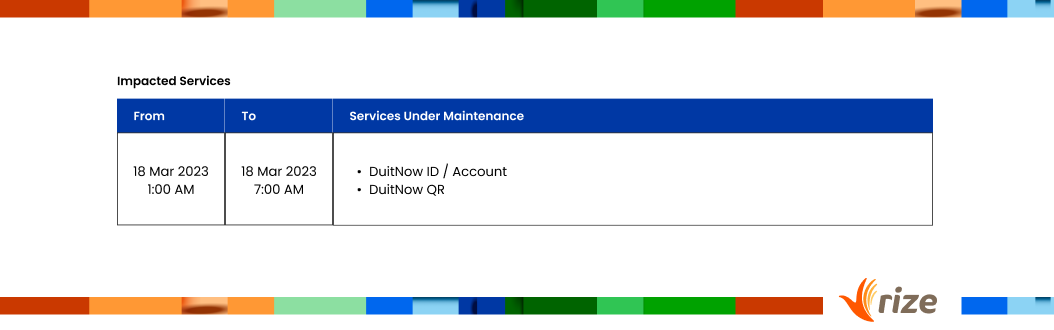

Hi Rizers,

Kindly be informed that DuitNow Transfer will be temporarily unavailable during a scheduled maintenance on:

We apologize if this has caused any inconvenience to you. Please contact our Customer Care at 1800 81 9149 if you need any assistance or have any questions. We are ready to serve you anytime, anywhere!

Great news! You can still enjoy 10% off Liga Super 2023 tickets when you use your Rize debit card to purchase tickets via Ticket Hotline!

The discount will be automatically rebated to your account.

Not on Rize?

Download Now!

Hi Rizers,

Kindly be informed that the following services will be temporarily unavailable due to schedule system maintenance:

We apologize if this has caused any inconvenience to you. Please contact our Customer Care at 1800 81 9149 if you need any assistance or have any questions. We are ready to serve you anytime, anywhere!

Hi Rizers,

Please be informed that the following services will be temporarily unavailable due to scheduled system maintenance:

Maintenance Details:

Date: 8th May 2023 (Monday)

Time: 11.00 p.m. – 12.00 a.m. (1 hour)

Remarks: The Rize app will be unavailable during this period as we are upgrading our database.

We apologize for causing inconvenience to you. Please contact our Customer Care at 1800 81 9149 if you need any assistance or have any questions. We are ready to serve you.

Hi Rizers,

Please be informed that the following services will be temporarily unavailable due to scheduled system maintenance:

Maintenance Details:

Date: 8th July 2023 (Saturday)

Time: 00.30 a.m. – 06.00 a.m.

Remarks: During this period all below applications inaccessible.

Affected Services:

- Rize - Digital Bank App

We apologize for causing inconvenience to you. Please contact our Customer Care at 1800 81 9149 if you need any assistance or have any questions. We are ready to serve you.

Hi Rizers,

Please be informed that the following services will be temporarily unavailable due to a scheduled system maintenance:

Details:

Date: 25 Nov 2023 (Saturday)

Time: 12:30 a.m. – 01:00 p.m. (12 hours 30 minutes)

We apologize for any inconvenience this may cause.

Please contact our Customer Support team for assistance.

- 1800 81 9149 (Local toll-free)

- +6016 299 6610 (Local & overseas)

Hi Rizers,

Please be informed that the following services will be temporarily unavailable due to a scheduled system maintenance:

Details:

Date: 3 Dec 2023 (Sunday)

Time: 02:00 a.m. – 06:30 a.m. (4 hours 30 minutes)

Date: 7 Dec 2023 (Thursday)

Time: 02:00 a.m. – 05:00 a.m. (3 hours 00 minutes)

Date: 9 Dec 2023 (Saturday)

Time: 12:30 a.m. – 12:30 p.m. (12 hours 00 minutes)

Date: 10 Dec 2023 (Sunday)

Time: 12:30 a.m. – 08:30 a.m. (8 hours 00 minutes)

We apologize for any inconvenience this may cause.

Please contact our Customer Support team for assistance.

- 1800 81 9149 (Local toll-free)

- +6016 299 6610 (Local & overseas)

UPDATE: The Rize app services have resumed.

Hi Rizers, the Rize app is experiencing intermittent service interruption. We are sorry for the inconvenience.

Hi Rizers,

The Rize app is experiencing intermittent service interruption for Android users. We are sorry for the inconvenience caused. We appreciate your patience and understanding.

If you require assistance during this time, please contact our Customer Support Team at:

- 1800 819 149 (Local toll-free)

- +6016 299 6610 (Local & overseas)

- or email rize-cs@alrajhibank.com.my

Please be informed that we will normalise a vast majority of customer accounts and transactions today. We are doing our best to resolve issues with the remaining accounts and hope to complete all by 05/12/2023.

We sincerely apologize for the disruption this may have caused you and thank you for your patience during this time.

Published date: 6 December 2023

Hi Rizers,

Please be informed that the Rize app is scheduled to undergo necessary system maintenance on Thursday, 7 December 2023, from 2.00 am to 6.30 am. During this time, incoming and outgoing transactions will not be available. We apologize for any inconvenience this may cause, but don’t worry, we’ll be back soon!

For assistance, please get in touch with our Customer Support team at 1800 81 9149 (Local toll-free) or +6016 299 6610 (Local & overseas).

January 2023

10th January 2023

Revision to the Specific Terms and Conditions

Dear Valued Customers,

Please be informed that the Bank’s Specific Terms and Conditions (“Specific T&C”) has been revised to include definitions of security codes issued by the Bank and security codes generated by other security devices, mobile application or other secured method authorized by the Bank. The latest Specific T&C is now available in our website. The revisedSpecific T&Cwill take effect on 1st February 2023 for our existing customers.

Pleaseclick herefor the details of the updates.

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd

[Registration Number 200501036909 (719057-X)

June 2023

20th June 2023

Revision to the Specific Terms and Conditions

Dear Valued Customers,

Effective 20 June 2023, the updated Specific Terms and Conditions applicable to Unit Trust (Retail Customers) will be applicable. Please refer to for the Specific T&C for the updated Specific Terms and Conditions. The revised terms and conditions will take effect on 12th July 2023 for our existing customers.

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd

[Registration Number 200501036909 (719057-X)

January 2024

1 January 2024

RIZE Deposit Campaign 2024

------------------------------

Dear Valued Customers,

1. CAMPAIGN PERIOD

This Campaign is valid from 1 January 2024 until 31 March 2024, both dates inclusive (“Campaign Period”).

2. ELIGIBILITY

This Campaign is open to all active Commodity Murabahah Savings Account-i (“CMSA”) account holders opened via Rize application, including those opened during the Campaign Period:

EXCEPT for the following categories:

a) Individuals whose CMSA account(s) have been suspended;

b) Existing Rize customers whose banking facilities with Al Rajhi Banking & Investment Corporation (Malaysia) Berhad (“ARB") is in arrears or whose accounts are delinquent, involved in fraudulent transactions, suspected

under Anti-Money Laundering related matters and/or any other unlawful activities which warrant ARB to take appropriate actions; or

c) Non-individuals or corporate customers.

(henceforth referred to as “Eligible Customer(s)”)

Pleaseclick herefor the details of the updates.

April 2024

5th March 2024

Revision to the Personal Financing-i Terms and Conditions, and Declaration and Authorisation

Dear Valued Customers,

Please be informed that the Bank’s Personal Financing-i Terms and Condition, and Declaration and Authorisation has been revised. The latest Personal Financing-i Terms and Condition, and Declaration and Authorisation are now available in our website. The revised Bank’sPersonal Financing-i Terms and Conditions, and Personal Financing-i Declaration and Authorisation will take effect on 27th March 2024 for our existing customers.

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd

[Registration Number 200501036909 (719057-X)

May 2024

July 2024

9th July 2024

Revision to the Specific Terms and Conditions

Dear Valued Customers,

Please be informed that the Bank's Specific Terms and Conditions ("Specific T&C") have been revised. The revisions are limited to:

- Section I: Liabilities (D) Specific Terms & Conditions applicable to Debit / ATM card, and

- Section II: Wealth Management (B) Specific Terms and Conditions applicable to Structured Product-i

The latestSpecific T&Cis now available on our website. The revised Specific T&C will take effect for our existing customers on 5th August 2024.

Pleaseclick herefor the details of the updates.

The previous version of Specific T&C, kindlyclick here

Al Rajhi Banking & Investment Corporation (Malaysia) Bhd

[Registration Number 200501036909 (719057-X)